By John Richardson

COMPARING LONG-TERM chemicals and polymers pricing patterns between different regions has made sense ever since our industry became global, with the influence of China on global pricing increasing since 2000.

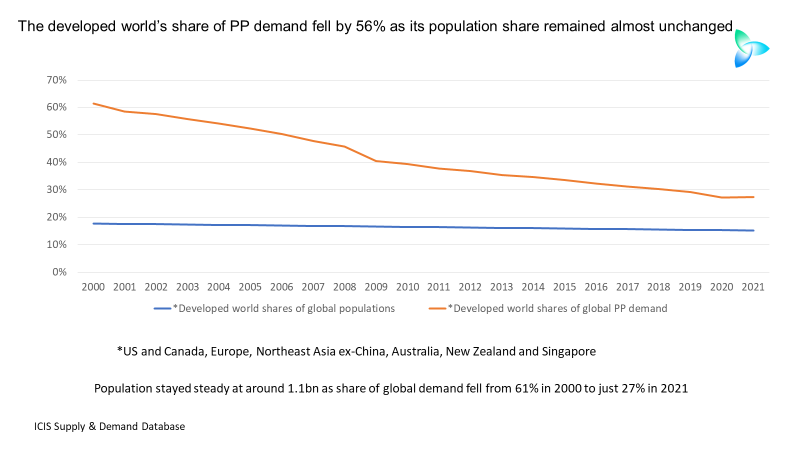

This reflects China’s much-greater role in driving global demand, which is disproportionate to the size of its population as the chart below tells us, using polypropylene (PP) as an example.

What applies to PP applies to every other chemical and polymer.

In 2000, China’s share of global PP demand was 15% versus its 21% share of the global population, according to the excellent ICIS Supply & Demand Database.

In 2005, a tipping point was reached as, for the first time, China’s share of global demand exceeded its share of the global population. In that year, China accounted for 21% of global demand compared with 20% of the global population.

Last year, however, ponder the significance of this: China took up just 18% of the global population but 41% of demand! China’s population only rose from 1.3bn to 1.4bn between 2000 and 2021 as its share of global demand increased from 15% to 41%.

Now let us compare China to the developed world.

The developed world’s share of global demand collapsed from 61% to just 27% in 2021, a 56% decline. This occurred as its population remained almost unchanged at around 1.1bn.

And here is the developing world.

Of the world’s three mega regions, the developing world saw by far the strongest population growth from 3.7bn in 2000 to 5.2bn in 2021. And yet its share of global PP demand only rose from 24% to 32%.

It is also worth repeating this slide from my 15 September post.

China accounted for no less than 60% of total global net imports of PP between 2000 and 2021. In nearest second places was Europe including Turkey at 18%. This was among the countries and regions that imported more than they exported.

Why the polyolefin world is re-globalising

But for a brief while, China’s role in driving global pricing in the markets that I follow – polyolefins – was greatly diminished. From March 2021 onwards, price premiums over much of the rest of the world versus China rose to all-time highs as polyolefins essentially de-globalised.

This was the result of expensive and tight container-freight markets that limited the ability of Asian and Middle East exporters to move oversupply out of northeast (NEA) and southeast Asia (SEA).

The oversupply was because of a cooling Chinese economy – the result of the Common Prosperity economic reforms – and big capacity additions in China. This compared with tighter markets overseas.

Pandemic-connected economic stimulus boosted demand, especially in Europe, the US and elsewhere in the developed world.

Polyolefins supply was constrained by a lack of feedstock from refineries due to pandemic-driven refinery rate cuts. The Texas Winter Storm in February 2021 and US hurricanes later in the same year added to PP and PE tightness.

But the polyolefin world is re-globalising because freight rates are coming down, as the chart below tells us.

This is the result of a fall in demand for durable goods. The decline in demand is the result of the global inflation crisis and the post-pandemic cycle out of spending on durable goods and back into services.

The fall in freight rates is said to be making it easier for the big Asian and Middle East exporters to move PP and polyethylene (PE) out of NEA and SEA.

China capacity additions are continuing at apace with China’s PP and PE demand heading for negative growth in 2022.

In PP, a combination of minus 1% growth and more new capacity could reduce 2022 net imports to 2.4m tonnes from 3.4m tonnes in 2021 and 6.1m tonnes in 2020. Meanwhile, Chinese PP exports are increasing.

The China slowdown is also having negative broader economic effects, especially in heavily export-focused economies such as Germany and Vietnam.

Declining European price premiums over China

As I discussed in my 19 September post – when I launched new weekly PP and polyethylene (PE) price indices comparing China to a group of other countries and regions – premiums are coming down. This is happening as pricing outside China falls closer to the very depressed levels in China.

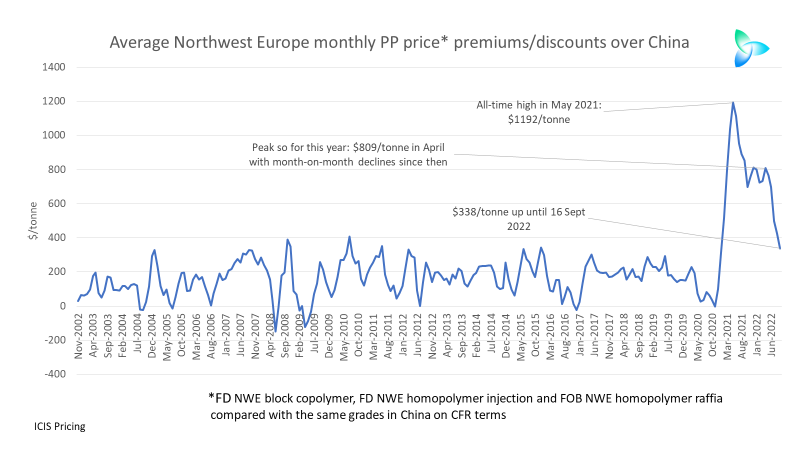

Now let us look in detail at Northwest Europe (NWE) pricing versus China, again just using PP as an example (the patterns are similar in PE).

Average NWE PP price premiums for block copolymer and raffia and injection grade homopolymer over China reached an all-time high of $1,192/tonne in May 2021. This was since our price assessments began in November 2002.

Premiums subsequently fluctuated within a narrow range, reaching a peak so far this year in April of $809/tonne. But since April, the premiums have tumbled. In September this year, up until 16 September, they were at $338/tonne, down from $425/tonne in August.

If we look at actual prices, we can see that European pricing has since April been falling closer to Chinese levels.

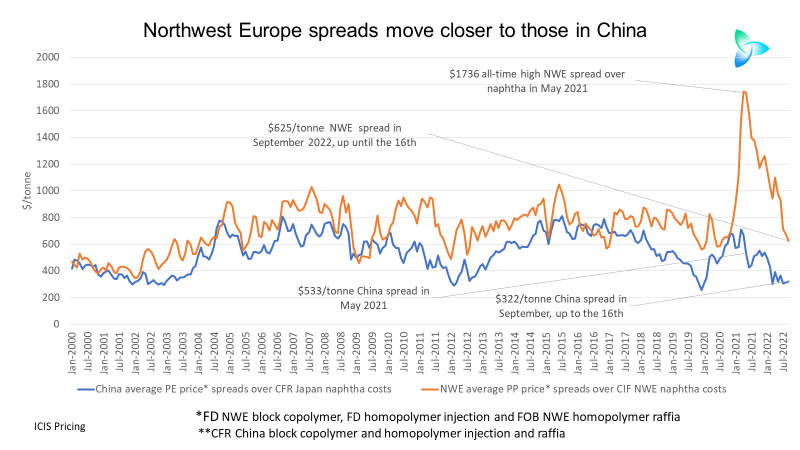

The big disparity in spreads between PP prices and naphtha feedstock costs has also narrowed.

The premium for NWE spreads over China spreads peaked at an all-time high of $1,203/tonne in May 2021. In September 2022, again up until 16 September, the NWE spread premium was just $303/tonne.

Spreads are a basic measure of profitability.

EPCA and the need for a debate on China

As delegates meet in Berlin between 4-6 October for this year’s European Petrochemical Association (EPCA) annual meeting, the first live annual meeting since the pandemic, much of the debate will no doubt focus on the European energy crisis.

The good news is that European gas prices may have peaked over the medium term, according to ICIS senior gas editor Aura Sabadus in this ICIS Think Tank podcast.

“The era of cheap Russian gas may have come to an end, but assuming all these plans for more LNG supply materialise in the next 2-3 years we’re going to see prices rebalancing. They may not go back to $8-10/MMBTu, but certainly not well above $30/MMBTu,” said Aura.

But gas rationing cannot be ruled if the northern hemisphere winter is cold, despite European gas-storage levels that are ahead of EU targets.

“Improving supply and muted demand in the period between summer and winter have helped European gas storage levels exceed the EU’s 80% target by October a month early. Germany may even be able to meet its target of 90% by 1 October,” wrote Will Beacham, Deputy Editor of ICIS Chemical Business in this ICIS Insight article.

While of course the energy issue is critically important for Europe, delegates must not lose sight of the re-globalisation of polyolefins.

Will European PP and PE price premiums over China return to their long-term averages?

In the case of PP for the same three grades mentioned above, monthly NWE price premiums over China averaged $161/tonne between November 2002 and December 2020. Between January 2021 and 16 September 2022, price premiums averaged $749/tonne.

What would be the consequences for European PP pricing and profitability if price premiums returned much closer to their long-term averages?

Delegates should also ponder the first three slides in this post and consider what happens next with global chemicals and polymers demand as attempts the biggest shift in its growth model since Deng Xiaoping’s Southern Tour in 1992.

What happens if China’s share of global demand starts to decline? There is a risk of negative chemicals growth in China next year, and possibly even beyond 2023, as nobody knows if the new Common Prosperity approach will work.

No other country or region would be capable of taking up the slack of the lost China growth momentum, given all the other economic challenges.