I worked for many years at a world-leading chemical company, ICI. But sadly, it lost its way as senior management began to focus more on financial metrics than market developments. In 2007, it disappeared.

Today, other companies including the once-mighty ExxonMobil risk making similar mistakes:

- EM was the world’s most valuable company just 9 years ago

- It joined the Dow Jones Industrials in 1928, and was its longest serving member

- But it was ejected from the Index in September

- And earlier this month, it had to take a $20bn write down on overpriced natural gas assets

Other companies made similar mistakes during the shale gas bubble. As I have warned here since March 2014, ‘The US boom is a dangerous game’:

- Many US companies assumed that oil would always be >$100/bbl, giving gas a feedstock cost advantage

- They expected China to continue growing at double-digit rates, and require ever-increasing petchem imports

- They ignored rising protectionist risks, and assumed they would always be able to ship tariff-free on a global basis

- And they had no time for the sustainability agenda, or for worries about plastic waste in the oceans

Now all these challenges are accelerating the paradigm shift from globalisation to sustainability, as I discussed last month.

The key issue is that world no longer needs, or wants, world-scale petrochemical plants to ship vast quantities of product around the world. Instead, companies need to move away from the ‘hub and spoke model’ that served them so well during the Boomer-led SuperCycle.

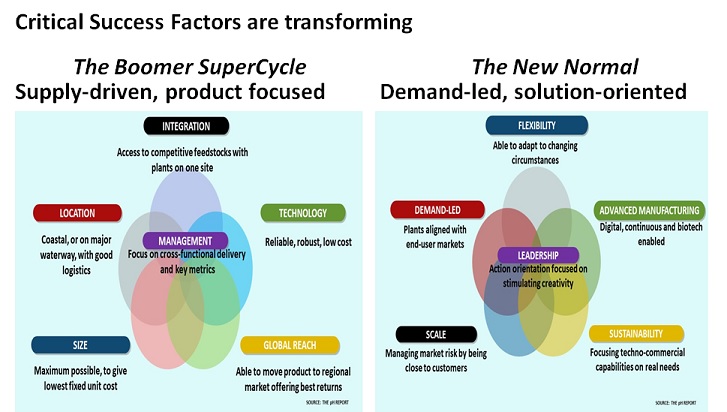

Essentially, 2020 has confirmed that the Critical Success Factors for business have changed, as the charts show:

- Integration. Location, Size, Technology and Global Reach were key in the SuperCycle

- Managers had to focus on cross-functional delivery by highlighting key metrics for their teams

- Today’s focus on Sustainablity, creates a need for Flexibility, local Scale, Advanced Manufacturing and being Demand-led

- Managers have to focus on providing leadership and stimulating creativity to achieve success in today’s New Normal

Companies need to go back to the pre-SuperCycle era, and build local production hubs to serve local markets – but based on renewable feedstocks.

THE 2021 CLIMATE CHANGE CONFERENCE WILL BE A GAME-CHANGER FOR US BUSINESS

Joe Biden’s election confirms that the world is changing in front of us. The Old Normal of fossil fuels and globalisation is no longer relevant. Instead, the New Normal of recycling and sustainability is key to future success.

Having lived and worked in the USA, I am also well aware that its companies – including ExxonMobil – have a fantastic ability to catch up very quickly, once they recognise that the world has changed.

As Biden starts to highlight the opportunities from the Green agenda, in terms of future business and job growth, I expect the US to accelerate away – especially with the Climate Change conference in November as a target date. The risk of continuing to fall behind the EU and China is far too great.

We can already see this happening with major US brand owners including Coca-Cola and Colgate agreeing to support per-item fees for packaging that is used for recycling:

“We recognize these systems in America have been chronically underfunded for a decade or more and can’t handle the types of packaging in use today.”

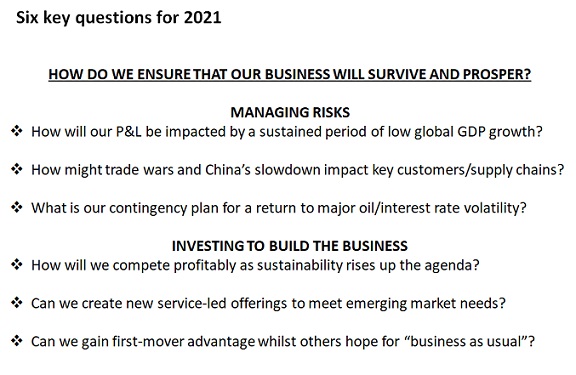

As the second chart suggests, US chemical companies need to focus on 6 key questions for 2021:

- The first is to accept that ‘business as usual’ no longer exists and that low global growth to continue

- Trade wars and China’s slowdown will impact key customers and supply chains – as will interest rate and oil price volatility

- Against this background, companies need to invest to meet the new challenges created by the sustainability agenda

- They need new service-led offerings to supply the Perennials 55+ generation – who will be the majority of future population growth

There was no reason why ICI should have disappeared. Its management simply failed to maintain a long-term focus on market developments. But the businesses themselves survive in new ownership, under better management. The Zeneca pharmaceuticals, business, for example, is just about to start delivering 3bn doses of its Covid-19 vaccine as part of AstraZeneca.

US chemical companies have fantastic new opportunities ahead of them. But Managements must stop assuming that “Wall Street knows best”. Instead, they need to focus on gaining first-mover advantage in today’s New Normal world. That way, they will achieve long-term market and financial outperformance.