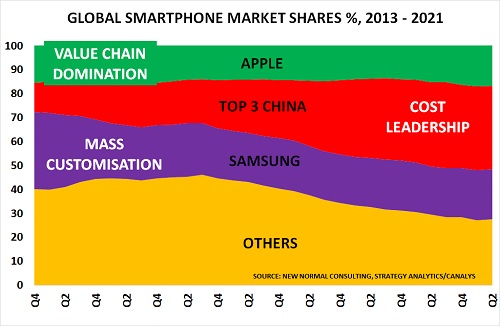

Smartphone sales confirm that global markets are continuing to pivot to the New Normal world. Back in 2014, Samsung dominated with its middle market positioning. But since then, its position has been squeezed as the market polarises between low-cost Chinese suppliers and Apple’s focus on adding services.

Every third smartphone used to be a Samsung. And only one in ten phones were Chinese. But today, as the chart confirms, the positions have sharply reversed:

- The top 3 Chinese players now have 37% of the market, and Xiaomi has overtaken Apple for the first time

- Samsung has just half their share – its lowest position since the trauma of the ‘Galaxy Note fires’ in Q4 2016

- And it continues to struggle with Covid-related shutdowns in Vietnam, as well as chip shortages

The market is effectively polarising. And Samsung is caught in the middle. It cannot compete with the volume focus of the 3 main Chinese players. where Xiaomi’s hardware margin is just 5%.

Neither can it match Apple’s focus on adding services to support its profitability. Their gross margin is close to 60%, versus 35% for the iPhone.

Apple’s iPhone continues to dominate the high-end smartphone market. And by discounting older iPhones to attract more price-conscious consumers, Apple can spread its costs over a wider customer base.

Its continuing focus on driving services growth also makes it very difficult for its competitors to catch up. It now has 700 million subscriptions to the App Store, Apple Music, Apple Pay, AppleCare, Apple TV+, Apple Arcade, Apple Fitness+, and other services.

Samsung’s core issue is that the global smartphone market peaked in Q3 2017 at 1.55bn as the chart shows, and has been slowing ever since. The problem is that 4bn people already own a smartphone, and most of the other 3.9bn can’t afford one.

Annualised volume was down 10% from the peak in Q2 at 1.39bn. And as I forecast back in 2017, competitive pressures have increased quite rapidly as the market slowed:

“It seems likely that a focus on price and affordability will come to dominate. In turn, pricing pressures on suppliers will intensify. The key challenge facing the market is that it has gone ex-growth.”

THE NEW NORMAL WORLD IS POLARISING

Another sign of the move into the New Normal world, as Gartner note, is that marketing budgets are tumbling as competitive pressures hit margins. They have hit an all-time low this year at just 6.4%, almost half of the 12.1% peak in 2016.

Formerly very successful companies such as Samsung are most at risk:

- They prospered in the past by focusing on the middle ground. But that positioning no longer works

- Their relatively high cost base compared to China means they can’t compete on price

- And they have been slow to move into services, and so can’t compete with companies like Apple

The New Normal world creates a stark choice for most companies. Doing nothing and hoping for a return to ‘business as usual’ in the Old Normal, will inevitably lead to a continuing decline in revenue and profits. Instead, they have to focus on being either the lowest-cost supplier, or on rapidly developing a more service-based offering.