The head of the IMF has warned again on the likely scale of the economic depression ahead:

“Global growth will turn sharply negative in 2020. In fact, we anticipate the worst economic fallout since the Great Depression.”

None of us have ever seen a health crisis on the scale of Covid-19 . Nor have we seen an economic crisis on this scale before. The best guide to what may happen is therefore likely to be the ‘Paradigm of Loss’ model developed by Elisabeth Kübler-Ross, to help explain how people react to a devastating change in their lives.

As the chart shows, the Paradigm suggests that Denial is the first reaction to a disaster, and we have certainly seen this occur since the pandemic began, as discussed here many times in recent weeks. Unfortunately, most commentators have added to this Denial by arguing that ’the world will see a quick, V-shaped recovery’.

This is clearly impossible, given the scale of the pandemic and the economic damage it has already caused. Unsurprisingly, the media are already starting to focus on the failure of governments to (a) prepare properly for the pandemic and (b) deliver the vital equipment needed to support front line workers and desperately ill patients.

It therefore seems likely that Anger will soon start to dominate as people begin to recognise that government incompetence has played a large part in this disaster. The trigger could come when the reality of job losses and the economic consequences start to become apparent, especially as the frustrations of a lockdown in the typical small apartment start to tell on home life.

It is too early to speculate in great detail on the Bargaining and Depression stages. But we can potentially start to identify a number of profound behavioural changes:

PEOPLE

- We could see an extended period of civil instability in many countries

- Lockdowns will lead people to focus on the home, rather than luxuries and travel

- Mass international/internal travel opportunities will reduce

BUSINESS

- Auto, consumer goods, electronics demand will focus on durability/sustainability

- Supply chains will be localised and reshoring accelerated in the western world

- Speed of response will be key, with inventory eliminated wherever possible

FINANCE

- Lower incomes/spending concerns will further encourage second-hand markets

- The bursting of financial/housing market bubbles will impact personal wealth

- Deflation will encourage saving instead of borrowing

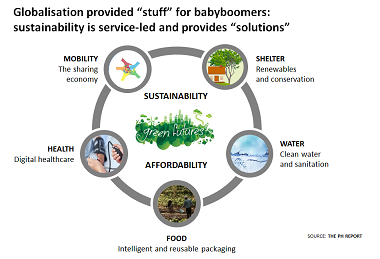

In reality, it therefore seems likely that we are moving rapidly into a New Normal world, where global supply chains prove fragile, and sustainability on a local basis becomes key. Similarly, the increasing volatility in financial markets suggests investors need to abandon their wishful thinking over central banks’ ability to solve the crisis.

The definition of Sustainability will also likely be expanded to include recognition of the valuable role played by lower-paid workers in keeping the wheels of the economy moving – hospital workers, carers, truckers, shop assistants etc.

Future Winners in this New Normal world will therefore be those with offerings focused on Sustainability and Affordability. In turn, the key drivers for revenue and profit will be based on a Value Proposition that helps people do more with less.