By John Richardson

THE ABOVE chart, using polypropylene (PP) as an example, neatly crystallises an argument I’ve been making since last August: that the changes in 2020 end-use demand resulting from the pandemic enabled petrochemicals and polymer producers to more than compensate for the overall weakness of economies.

Despite the collapse of GDP growth last year, the rise in demand for medical applications (think of PP face masks and hospital gowns) provided huge support to consumption. So did an improvement in demand for food packaging as people ate more at home and less in restaurants. Demand for household appliances and electrical manufacturing rose as the middle class spent more money on durable goods during lockdowns.

In PP, there were sharp increases in end-use demand for medical applications, packaging and household appliances as consumption into autos, construction and industrial equipment manufacturing declined.

It will therefore make little difference to petrochemicals demand whether we get on top of the pandemic in 2021.This is, of course, only from a hard-hearted dollars and cents perspective.

The emergence of new coronavirus variants has raised the prospect that adjusted versions of vaccines will need to be developed, leading to an extension of the lockdowns.

But this would merely delay the cycle out of demand for petrochemicals in medical applications – i.e. hygiene products and personal protective equipment – and back into other end-use sectors such as automobiles, airlines and hotels.

Sure, at some stage we might see peak demand for new washing machines, laptops, game consoles, rolls of wallpaper and paint as these are occasional purchases. There are only so many layers of paint that the middle classes can apply to their walls because they are bored during lockdowns.

Consider these remarkable statistics, though: US households collectively saved $1.4tn in the first nine months of last year, about twice as much as what they saved in the same period a year earlier, according to Berenberg Economics; the eurozone household savings rate rose from 12.4% in Q4 2019 to 16.7% in the first quarter of 2020, then shot up to 24.6% in Q2 before falling back to 17.3% in the third quarter, said UBS.

High savings mean lots of further demand for pandemic-related goods if lockdowns largely persist. Or if we win the battle against the pandemic in 2021, high savings mean much more demand for “old world” goods and services such as automobiles and flights.

We must also consider economic stimulus.

The White House doesn’t need a supermajority of 60 or more in the Senate to pass its new stimulus bill, which will add to the economic juice provided by a smaller bill that became law late last year. Compromises are likely on the details of the new bill and its overall price tag of $1.9tn. But it will still be huge, representing the largest stimulus boost to the US economy since the Second World War.

Last December, the EU approved a $2.2tn budget and stimulus package after overcoming objections from Hungary and Poland. The agreement paved the way for the EU to put into effect not just its seven-year budget but a $909bn pandemic relief package.

And you can bet your bottom dollar that other developed economies such as Australia, Canada, Japan and South Korea would not hesitate to provide further emergency stimulus if required. Interest rates are unlikely to rise by enough to prevent them from doing so.

The implications for global PP demand

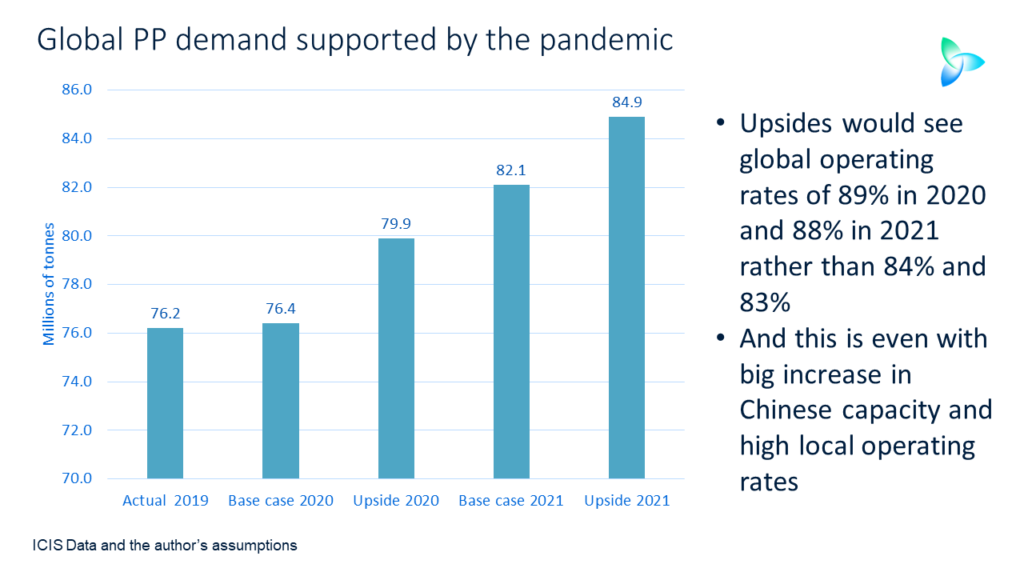

Our base sees global PP demand in 2020 edging up to 76.4m tonnes from 76.2m tonnes in 2019, an increase of 0.2%. Context is so important here. This would be far from a disastrous historical performance. In 2008, demand fell by 3% versus the previous year because of the Global Financial Crisis.

This underlines my argument that petrochemicals demand in general has become more divorced from GDP growth due to pandemic-related shifts in end-use consumption. If petrochemicals demand were linked to GDP then of course demand would have completely cratered in 2020, as the pandemic was a far, far worse economic event than the Global Financial Crisis.

I believe that PP demand in 2020 performed even better than our base case from the evidence of discussions with market sources. Please note, as always, that what follows are preliminary numbers and should not be viewed as proper estimates.

Our base case sees 5% and 4% respective falls in Canadian and US demand in 2020 over 2019. We also forecast a 4% fall in European demand and a 7% decline in Northeast Asia ex-China consumption (Japan, South Korea and Taiwan).

But the latest American Chemistry Council data suggest US PP sales were up by 2.7% in 2020. I assume growth is likely to be similar in Canada. Contacts say that European demand might have increased by 2%. In Northeast Asia ex-China, market intelligence suggest that growth was also at 2%.

We must next evaluate the 10,000lb gorilla sitting in the corner of the room. Our base case sees Chinese growth at 7%, but consumption growth was instead more likely in the region of an astonishing 13%.

My upside case for 2020 demand – which you can see in the chart immediately above – assumes these higher growth rates. I have slightly moderated our base case decline in demand in the Asia & Pacific region, which includes the Indian subcontinent and southeast Asia. But I have left the declines in growth in Africa, the Middle East, South & Central America and the Former Soviet Union unchanged from the base case.

What counts most of all are my revisions to growth in the developed world and China because the regions were together responsible for 72% of global consumption in 2020, both under our base case and using my revised numbers. China alone accounted for a humungous 41% of global demand – under again both the base case and t upside. This was by far the most for any country and region. Europe was in distant second place at just 16%.

As for this year, I have assumed a percentage point higher growth than our base cases for Canada, the US, Europe and Northeast Asia ex-China on high savings rates and large government stimulus.

I assume Chinese growth will moderate to 7% in 2021 from 13% in 2020 on end-of-year overstocking and an export-related slowdown in Q1 2021. But in the second quarter, an end to the global container-freight shortages should result in a recovery in exports. Also expect China to launch big economic stimulus to shore up growth, as this year marks the 100th anniversary of the founding of the Chinese Communist Party.

The 2021 growth rates for Africa, Asia & Pacific, the Middle East, South & Central America and the Former Soviet Union are unchanged in the upside versus the base case.

The upside case sees 2020 demand at 79.9m tonnes versus our base case of 76.4m tonnes. The 2021 upside is 84.9m tonnes against our base case of 82.1m tonnes. These upsides would see global operating rates at 89% in 2020 and 88% in 2021 compared with our base cases of 84% and 83%. This is despite my assumptions of big capacity increases and high operating rates in China.

The big demand dilemmas

I believe the above chart also supports my arguments about why PP demand was so much better in 2020 than just about anybody had dared to expect. Propane dehydrogenation (PDH)-based PP margins performed very well on an historic basis considering the scale of the economic challenges. It was the same pattern in naphtha-based margins. If demand had collapsed in the way that most people had expected, profitability would have been much worse.

(Note that US PDH-based and other PP margins went through the roof in 2020 with the pattern continuing this year. This was the result of tight PP markets and declining propane costs. Northeast Asian margins performed well last year but have declined during 2021 on the slowdown in China that I’ve been detailing over the last couple of weeks).

Reduced PP supply was also a reason for good margins. There were many PP outages in Asia and reduced global availability of propylene feedstock from refineries – a result of the collapse in gasoline demand. This was an issue particularly in the US, given most of the country’s propylene supply comes from refineries following the rise in ethane cracking.

But I firmly believe demand was the key factor in 2020. This was more important than reduced supply in maintaining the health of the global PP business. And, for the reasons outlined above, I expect strong demand to be the dominant story in 2021.

“Everything that can be counted does not necessarily count; everything that counts cannot necessarily be counted,” Albert Einstein once famously wrote on a blackboard. Hear, hear. People talked about supply as the main supporter of the PP market in 2020 because demand was too difficult to measure.

If we are to improve the way we assess demand, we must invest in improved digitalisation (which is very different from digitisation) to make more efficient use of existing data. New data sets will emerge from assessing micro changes in consumer spending patterns and the effects of a myriad other influences, such as the scale and effectiveness of government stimulus.

New demand estimates must also be built on the four headline shapers of global demand, trade flows and investment: sustainability, demographics, geopolitics and the pandemic.

It isn’t going to be easy and will cost money. But if we don’t spend money on new and much more sophisticated demand models, we will leave greater quantities of money on the table.