By John Richardson

IT IS all about getting through the next 12 months with minimal damage whilst preparing for what the New Normal will look like when the COVID-19 crisis is over. I believe that changes in the nature of demand will be accelerated by the virus. These changes were already well underway before this crisis happened.

But right now, as I said, the immediate focus is getting through the next 12 months. So, in order to help you focus through all the noise, let me first start with a guide on what I see as the short-term challenges. I will revisit the long-term challenges in later posts.

For advice on how you need to respond contact me at john.richardson@icis.com. We can then work together, with our ICIS team of pricing editors, analysts and consultants, to find solutions for your business.

Let’s start with what I see as the short-term challenges:

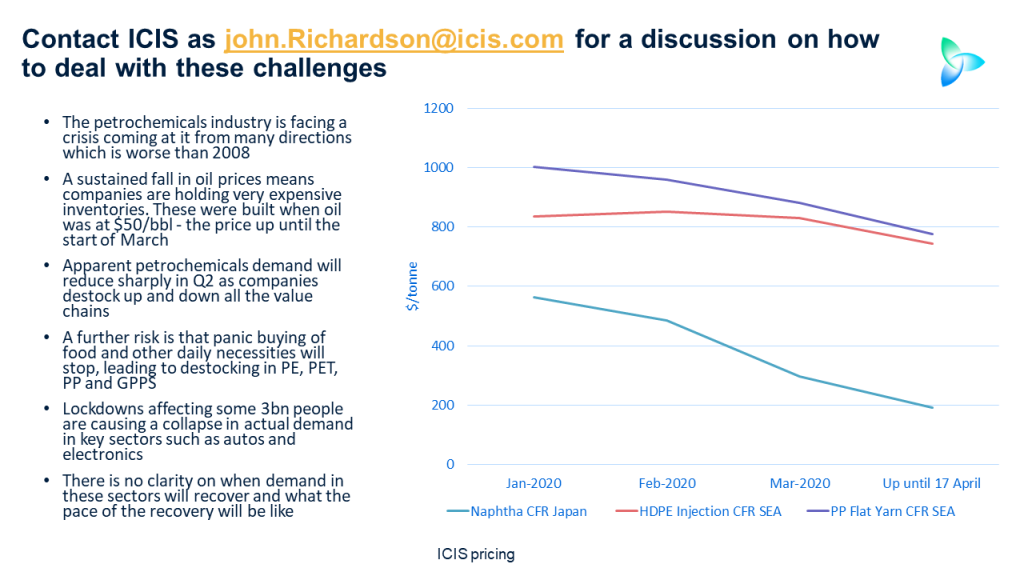

- The industry is facing a crisis coming at it from many directions which is worse than 2008.

- The sustained fall in oil prices means companies are holding very expensive inventories. These were built when oil was at $50/bbl – the price up until the start of March. As I flagged up on the blog before the OPEC+ production cuts were announced, no amount of cutbacks were going to compensate for the unprecedented loss of demand.

- This means that apparent petrochemicals demand will reduce sharply in Q2 as companies destock up and down all the value chains.

- A further risk is that panic buying of food and other daily necessities will stop. A destocking process could then take place in the polymers that go into packaging – PE, PET, PP and GPPS.

- Lockdowns that affecting some 3bn people are causing a collapse in actual demand in key sectors such as autos and electronics.

- There is no clarity on when demand in these sectors will recover and what the pace of the recovery will be like.

Solutions don’t have to be rocket science

When I pick up a newspaper these days (virtually of course), by the time I’ve read through it from the front cover to the very sadly very dull sports section as there is of course no sport, my head is literally spinning. Anxiety has gone through the roof about the financial and emotional impact on my family, friends and colleagues.

I am sure all of you out there are going through the same experience, both personally and for your businesses.

In the middle of all this harmful noise, we can so easily miss solutions that are hardly rocket science. Let me give you a personal example:

- A friend runs a food wholesalers’ business. He’s had to lay off most of his staff because the majority of his business was supplying sporting events, concerts and small lunch-time cafes.

- But he has quite successfully switched to selling directly to consumers.

- One problem, though, is he has big lorries and small cargoes, a waste of space, fuel and time.

- A group of us were discussing the problem and we suggested using out-of-work ride-hailing drivers.

Ideas like this will only come through a free exchange of ideas. So, again, we are here to help. Please contact me at john.richardson@icis.com.